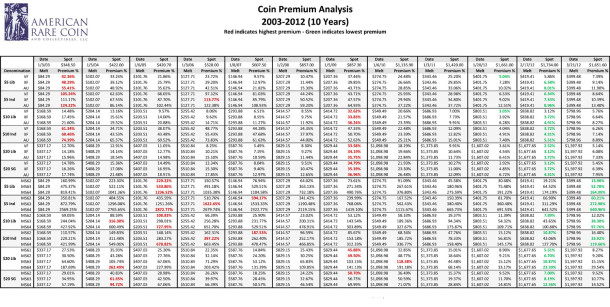

Many US circulated gold coins like the $5 Indian, $10 Indian, $10 Liberty, $20 Liberty and the St. Gaudens Double Eagle gold coins are all coins who’s numismatic value has traditionally out paced their gold value. The value beyond the coin’s intrinsic “gold value” is what we refer to as a premium and these coins have in years past sold at premiums well beyond their gold content. Currently, with the rapid rise in gold prices, these gold coins are selling at or near their 10 year premium low relative to their gold value. Below is a ten year chart illustrating the premiums these US gold coins have traditionally maintained and roughly where they are currently.

There are some experts who believe these early American gold coins “may very well be the new low hanging fruit”. If history repeats itself, market conditions may reflect past premiums making these US gold circulated coins worth far more than at current levels.

If you are looking for a speculative position with potential for positive returns, buying US gold coins, just may provide future profits worth the risks.